One Child Creates An Economic Ripple

Last month, China made the landmark decision of reversing its one-child policy by allowing married couples to have two children, after over 30 years of restrictions. This move was spurred on by the failure of previous attempts to stimulate childbirth and by the increasingly apparent slowdown in the Chinese economy. This policy shift won’t help the current situation, which is driven the bursting of a credit-fueled investment bubble. But one of the supposed benefits of central planning is the ability to look further into the future, and when China’s leadership does, it doesn’t like the outlook. You see, China’s one-child policy created a demographic wave that is starting to crash on the economy.

Let's remember that there are three primary sources of growth in any economy: (1) labor, (2) capital, and (3) productivity. Labor-driven growth originates from adding more workers to an economy. Capital-driven growth comes from deploying more equipment. And lastly, productivity-driven growth is the result of squeezing more output from existing labor and capital.

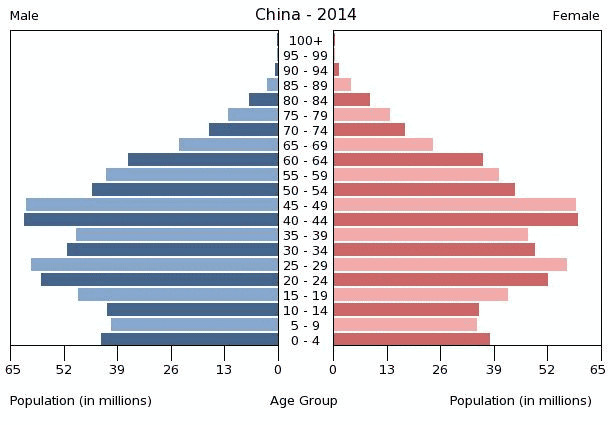

Labor in China is unlikely to be a meaningful source of growth for the economy for decades to come. Sometime in the next few years, those leaving the labor pool will exceed those entering it. By 2035, 20 percent of the population is expected to be over 65. Young people entering the workforce—who are almost invariably only-children, due to the one-child policy—are already complaining about the pressures of taking care of aging parents on their own; they’ve been dubbed by the Chinese media “the loneliest generation.” Estimates from the UN and the Population Reference Bureau suggest that the new policy will add 23.4 million extra people to the population by 2050 (Chinese officials are putting the number at 30 million). Even so, with the dependency ratio on the rise, labor may soon emerge as an economic drag.

What about capital? China is weaning itself off of a debt-fueled investment binge that has mis-allocated capital and created significant excess capacity. Its housing boom has turned to a bust. Might the dearth of home buyers be partially attributable to the one-child policy? Simple math suggests China needs to spend at least the same amount this year as last to not shrink. But there are plenty of signs of excess in past allocations; investing more today to stimulate the economy—in the face of overcapacity—can lead to an even harder landing in the future.

As for productivity, surely a factory worker is more productive than a farmer, and the ongoing urbanization can drive growth for many years to come, right? Not really. While China’s data indicates significant potential for migration-fueled growth, much of this urbanization has already happened. First, China defines a region as “urban” if it has a population density of 1500 people per square kilometer…but by that definition, Houston (America’s fourth largest city) is rural! Second, the most likely age band to migrate is 16-24 year-olds, and that age band has shrunk by 25% between 2010 and 2015, another impact of the one-child policy. Third, China’s hukou residency permit system classifies individuals according to where they live, not where they actually are (and we’ve already had lots of migration). Thus, there are those working in actual cities that are deemed rural, or working in factories but are listed as farmers, and there are fewer potential migrants!

So what? My interpretation of these facts implies that China will continue to slow for the foreseeable future, even beyond the hiccups surrounding the transition from investment- to consumption-led growth. The world is underestimating Chinese urbanization, and there is a structural headwind that makes a low single-digit growth rate not just possible, but likely. This has massive implications for asset prices, interest rates, commodity markets, and inflation rates. It may take a village to raise a child, but one child can create global economic ripples.

Vikram Mansharamani is a Lecturer at Yale University in the Program on Ethics, Politics, & Economics. He is the author of BOOMBUSTOLOGY: Spotting Financial Bubbles Before They Burst (Wiley, 2011). Visit his website for more information or to subscribe to his mailing list. He can also be followed on Twitter or by liking his Page on Facebook.