Within the Gloom, A Travel Boom?

As the U.S. stock markets race to new highs, there has been increasing chatter about a forthcoming correction. Economic chaos reigns in Europe with constant debates about austerity and bailouts, and China seems destined to slow further as its credit-fueled investment boom ends. Commodity markets have tumbled, threatening the economies of Australia, South Africa, and Brazil, to name a few. In short, the economic horizon is cloudy – at best. There is increasing fear in many industries – including hospitality and travel – that we may be in another “bubble,” with the inevitable “burst” around the corner.

Given this fact, what should one do? Cut back on investments in fear of correction so many seem to feel is inevitable? Slow plans for future expansion? Double down and try to maximize business while it is here to be had?

While it’s very easy to focus on this short-term potential gloom, I think it’s also quite risky to do so. Underneath the headlines lie the makings of an unprecedented global consumption boom. With Energizer-bunny consistency, the emerging market middle class continues to grow…and grow…and grow.

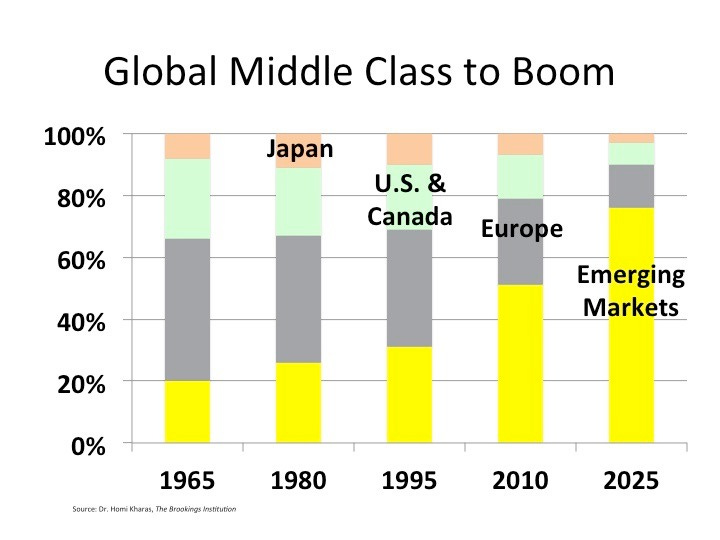

The chart above illustrates the global flip-flop that has taken place since 1980, when three out of every four consumers in the world were based in the developed world. By 2025, it’s likely that three out of every four consumers will be based in what we today call the emerging world – with enormous implications for everything from food to fuel to healthcare – and, of course, to travel. Stop and think about this fact: the source markets of the majority of business 30 years ago will be the source markets of the minority of our business in just 10 years.

Think the airports you travel through today are crowded? Think again. The forthcoming boom in tourism and leisure travel is likely to pressure the entire hospitality system as those with newfound income indulge in vacations and global travel for the first time. High on the list of many emerging market consumers are the tourist destinations in the United States and Europe. Many young couples from countries such as China and India dream of being able to afford a honeymoon in Paris. The hope of seeing the United States is a still an unfulfilled vision for many of these young couples.

Economists debate things such as whether China and India will grow at 3% or 8%: the reality is that for most businesses in the hospitality sector, the answer to this debate is irrelevant.

There is no debate as to whether the middle classes in these developing countries will continue to expand – it’s just a question of pace.

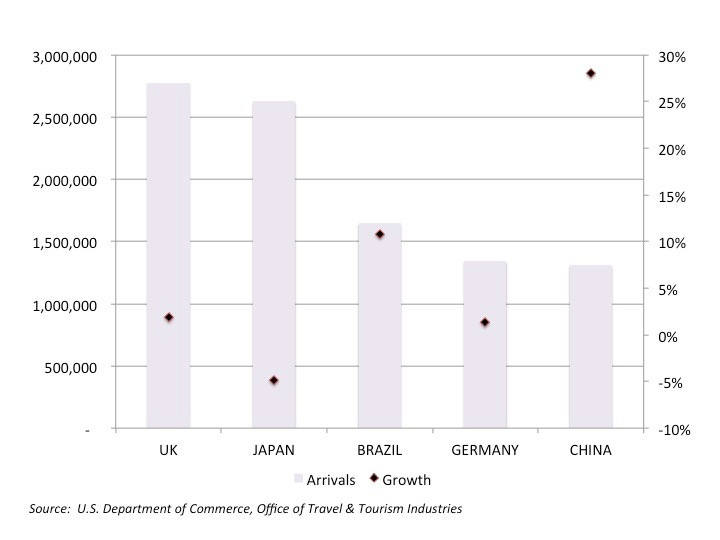

Consider the following chart that explores the top five originating countries of 2014 tourist arrivals into the United States.

It’s worth highlighting that while China has risen to the #5 position, its annual growth rate at 28% far exceeds virtually all other originating countries. Interestingly, the second fastest growing originating country for tourist arrivals in the United States is Brazil, another so-called emerging market, at 11%. Perhaps a reflection of demographic dynamics, Japan’s tourist arrivals are now falling. It’s also important to note the relative size of the growing economies versus the size of the stabile economies. China’s population, for instance, is ~20x that of the United Kingdom. The impact of rapid growth from huge populations is a double-whammy that seems likely to generate an unprecedented consumption boom.

John Kenneth Galbraith has noted, “There are two kinds of forecasters. Those who don’t know and those who don’t know they don’t know.” I’ll leave it to you to decide which I may be, but in the midst of all this gloom, I see a forthcoming travel boom.

Vikram Mansharamani is a Lecturer at Yale University in the Program on Ethics, Politics, & Economics and a Senior Fellow at the Mossavar-Rahmani Center for Business and Government at the Harvard Kennedy School. Visit his website for more information or to subscribe to his mailing list. He can also be followed on Twitter.