Drill, Baby, Drill!

America's hydrocarbon industry can reduce geopolitical tensions, lower inflation, and yes, believe it or not, help save the environment.

The world is fragile, something we all feel as wars rage, inflation persists, economies slow, and the climate changes. Unlocking America’s vast energy potential and aggressively developing our hydrocarbon resources is one strategy that could reduce geopolitical tensions, lower inflation, and yes, believe it or not, help save the environment.

Issue #1: Geopolitics

We currently have two major wars (both proxy wars that are part, I would argue, of the US-China War) taking place, one between Russia and Ukraine and the other between Israel and Hamas/Iran. Both wars are being funded, directly or indirectly, through the sale of petroleum and petroleum products.

Consider Moscow’s situation. Despite banning the import of Russian oil, liquified natural gas, and coal in 2022, the United States still buys lots of petroleum products that originate in Russia, thereby funding Putin’s war machine. Shockingly, this is allowed per the executive order as Russian crude oil that is refined in India, for instance, can be sold in the United States.

This dynamic has produced a set of “laundromat” nations that buy sanctioned crude oil and proceed to sell products made from that oil without any constraints. As noted by The New York Times: “This activity is legal: Once Russian crude oil has been “substantially transformed” by being refined in another country, it legally ceases to be Russian. The same standards have long applied to oil from other nations that are under sanctions, like Iran and Venezuela.”

Further, because Europe is dependent upon imported gas, imports of Russia liquified natural gas have risen 40% since the invasion of Ukraine, further enriching Moscow. And it’s not just Europe, it’s also the Northeastern part of the United States. In a letter to President Joe Biden dated October 27, 2022, Eversource CEO John Dolan lamented the implications of American dependence on foreign sources for natural gas:

To the extent New England power generators are forced to increase their reliance on foreign-sourced natural gas – if that is even possible – it will exacerbate well-documented shortages in Europe. More fundamentally, from a national security perspective, it will put upward pressure on prices in the international market for natural gas. As a major gas supplier, Russia will directly benefit from higher prices, and that in turn threatens to subsidize the Russian military and prolong the war in Ukraine. [emphasis added}

In addition, let’s not forget that the war in Israel began with an attack by Iran-backed Hamas, and Iran is obviously funded by oil revenues. It’s not a big jump to say that Hamas is funded by oil revenues. Interestingly (but surely not coincidentally), Iranian oil exports hit a 5-year high, despite US sanctions, earlier this year. Also noteworthy is that during the first half of 2023, China imported more than 11 million barrels of crude oil per day, 10% more than they did in the same period of 2022. So, what we have is Chinese money, flowing to Iranian coffers, and used to support Hamas. According to a recent Reuters article:

Iran notes that it’s producing and exporting around 3mm barrels of oil per day. Reports indicate that Tehran earned more than $40 billion from oil exports in 2022, up from the pre-Ukraine rate ~$25 billion. When we factor the Iranian state budget is based on producing 1.8mm barrels of oil per day at $85 per barrel, we can guess that the Islamic regime is likely flush with cash. Throw on top of that the recent release of $6bn of funds seized by the United States that are going to be made available to Tehran (although that may now be paused), and it’s not unreasonable to assume Iran was emboldened to give Hamas a green light to attack Israel, likely to scuttle the normalization of relations between Israel and Saudi Arabia.

SO WHAT?

Given the obvious link between high oil prices and the ability of Iran and Russia to wage war, might an increase in US hydrocarbon production both lower global prices and decrease dependency upon those regimes? If the US were to meaningfully increase its production of natural gas and make it available to Europe via LNG shipments, might this deprive Russia of much needed cash? We also know that additional supply, all else equal, would lower the prices of crude oil and natural gas, thereby lowering revenues — even if sales continued. Relatedly, how might increased US hydrocarbon production impact Iran’s attitude towards the West? Might the mullahs of Tehran be forced to deal with rising domestic unrest, rather than support terrorism, as their funding dried up? Of course, one downside of lower prices is that it provides economic relief to China, one of the world’s largest importers of crude oil and petroleum products.

SIDE NOTE: As I prepare to transition to a paid-only newsletter service, I’m experimenting with ways to improve the value of my offering. One idea I’m trying is to harness the collective insight of the amazing group of readers that have been attracted to my global generalist perspective. Given that rationale, I’m going to make these newsletters interactive…so let’s turn to our first poll:

Another important variable is US demand for petroleum products. Unfortunately, there is a mismatch between the type of crude oil needed by our refineries and the crude oil we produce domestically, but that can be fixed with investments. What if American energy companies invested in optimizing domestic refineries to handle the lighter, sweeter crude oil that happens to be available in the United States? Might this reduce global demand for petroleum products, thereby disincentivizing (or undercutting the economics of) “laundromat” countries from helping Russia and others monetize their hydrocarbons?

Issue #2: Economics

Given inflation is a major economic issue of our day, it’s important to note that inflation is a de facto tax on the poor and working class. It slows economic activity as budgets are strained and reduces business confidence as investments may get postponed due to the economic uncertainty produced by inflation.

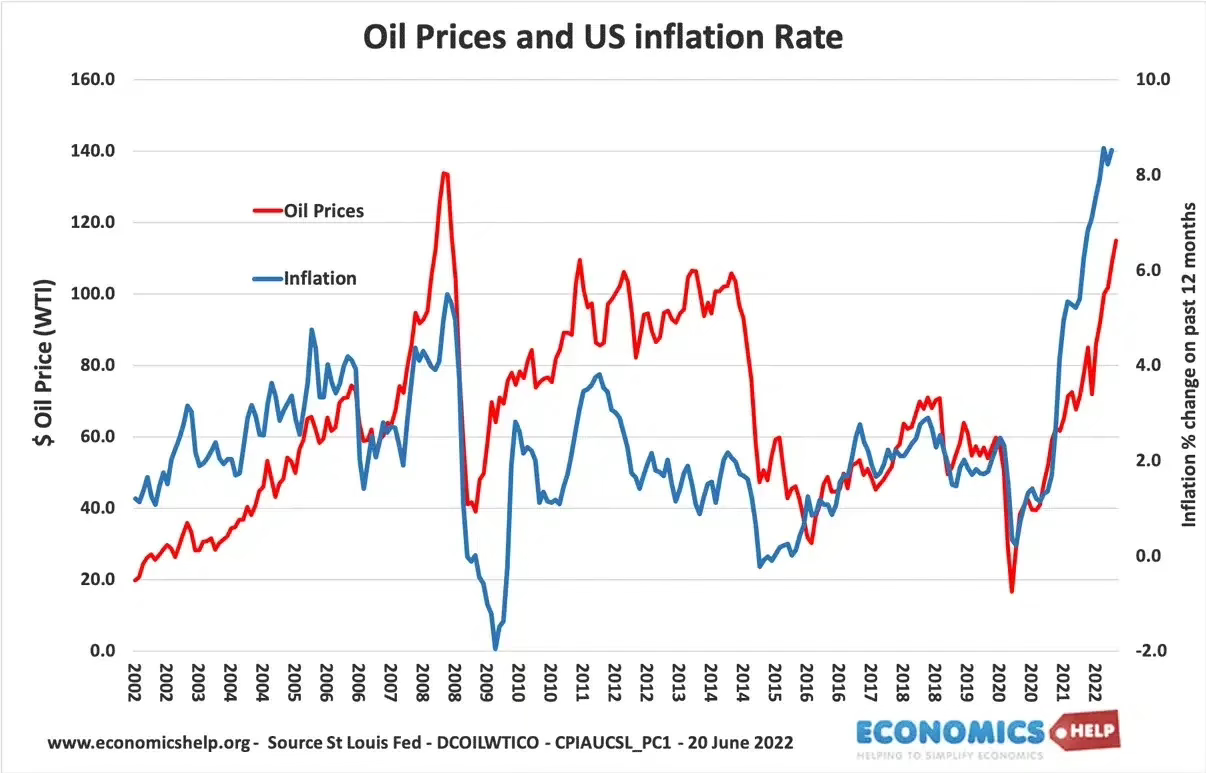

In addition, it’s important we don’t fool ourselves by distinguishing between core and non-core inflation. Energy prices, which are are admittedly more volatile than other prices, impact the prices of everything carried by ships, planes, and trucks. Don’t believe me? Go buy a plane ticket. Even the US Chamber of Commerce notes, in a report published in June 2022, that “high diesel prices are flowing through to countless goods and services.”

The blunt reality is that increased energy production will lower prices across the board (not just energy prices). And while lower energy prices may not “eliminate” sticky inflation, it will surely reduce the upward pressure exerted on prices. All else equal, more supply leads to lower prices, and lower prices drive lower inflation.

Further, there is an impact on consumer and business confidence. Inflation and price uncertainty usually depresses consumer confidence, economic activity, and business investments. Stable prices do the opposite: they lead to greater consumer spending, higher economic activity, and robust capital expenditures from business.

SO WHAT?

Increasing US hydrocarbon production would lower inflation. If American consumers are less exposed the vicissitudes of global oil prices, might they be more confident and spend more? Could that drive greater economic activity? And of course, business confidence and therefore spending would rise if there were less economic uncertainty. Thus, allowing US hydrocarbon production to grow could power the economy via lower and stable energy prices, lower inflation, and greater business and corporate confidence about future prices levels.

Issue #3: Environmental Impact

Consider two alternatives: (1) drilling for oil in a sparsely populated area of Texas, subject to the rules and regulations imposed by permit-issuing bureaucrats who care about the possible impact the project may have on the environment; or (2) drilling in the Okavango delta region of Botswana, one of the last remaining wildlife refuges in the world in which nature has been preserved the environment protected. Which do you think might have a greater impact on the planet?

Or how do you think drilling fluids, coincident methane gas, or other environmental toxins from energy production are treated in the developing world, compared to how they are treated in the United States? For better or worse, producing a barrel or oil or a cubic foot of natural gas in America is better for the environment than producing a similar volume of the same resource in a developing country that doesn’t have environmental regulations. What this means, simply, is that if you want to protect the environment, you want to increase production in America and reduce it in less regulated regimes.

It’s also important to think about the environmental footprint of extracting hydrocarbons. Turns out, in addition to inappropriately handling energy production byproducts and externalities, many of the nations from which America is currently importing crude oil have significantly higher environmental costs associated with their production than those of US production.

SO WHAT?

Is it possible that increasing US fossil fuel production will actually lower carbon emissions or help the environment? Given the world will continue to consume hydrocarbons for the indefinite future, wouldn’t it make sense to replace production that doesn't care about the environment with production that does? As counterintuitive as its seems, one of the most promising strategies to protect the environment may be to increase US oil and gas production as rapidly as possible to displace production from emerging economies that don’t really care about the environment.

One of my major issues during my campaign for the US Senate was about how US energy policy imposed certain costs on the American people while generating, at best, uncertain benefits for the environment. We chose to do this while China had chosen a strategy that produced certain benefits for the Chinese people (via reliable, cheap hydrocarbon-based energy) and uncertain costs for the environment. Let’s not forget that China is deploying 2 new coal-fired power plants each week and is not subject to any carbon emission restrictions before 2030. Net net, the environment is not necessarily better when American restricts is use of reliable hydrocarbon energy.

Last poll:

As I often state, we simply cannot know what the future holds for our families, businesses, or careers. The best we can do is to consider alternatives and to think through possible ramifications before events transpire, a process that will better equip each of us to deal with the uncertainty that is sure to characterize the future. And when I do that, it sure seems like American energy production offers an elusive trifecta of reducing geopolitical tensions, fighting inflation, and helping to save the environment.

About Vikram Mansharamani

Dr. Mansharamani is a global generalist who tries to look beyond the short term view that tends to dominate today’s agenda. He spends his time speaking with leaders in business, government, academia, and journalism…and prides himself on voraciously consuming a wide variety of books, magazines, articles, TV shows, and podcasts. LinkedIn twice listed him as their #1 Top Voice for Global Economics and Worthprofiled him on their list of the 100 Most Powerful People in Global Finance. He has taught at Yale and Harvard and has a PhD and two masters degrees from MIT. He is also the author of THINK FOR YOURSELF: Restoring Common Sense in an Age of Experts and Artificial Intelligence as well as BOOMBUSTOLOGY: Spotting Financial Bubbles Before They Burst. Follow him on Twitter or LinkedIn.

Vikram, hope your family is doing well. Turned 75 this year so we decided to sell the business and retire for a while. Not sure for how long but I know I can’t stop completely. My new venture will happen simply by being in the right place at the right time. Some very logical insight about our current domestic and world future. Why isn’t you suggestions taken more seriously here in the states? Unfortunately we both know why. Hope you’re thinking about running for office again. Bob and Sally

Apologies... I inadvertently hit "reset" on the third poll. Here's the data that was deleted. There were 93 votes, 81 of which were "YES", 7 votes for "NO", and the 5 "UNCLEAR".